Out Of This World Info About How To Settle Debt With Chase

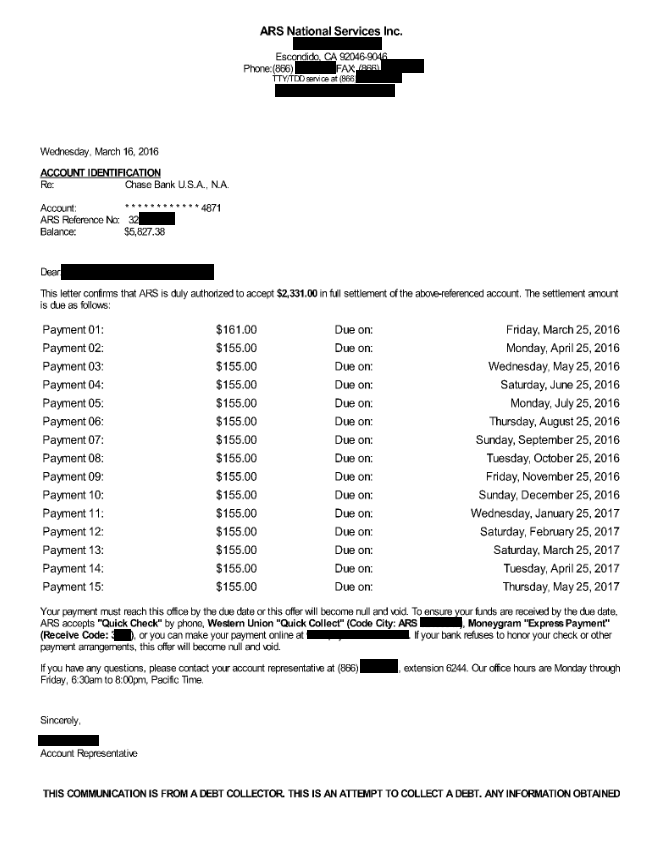

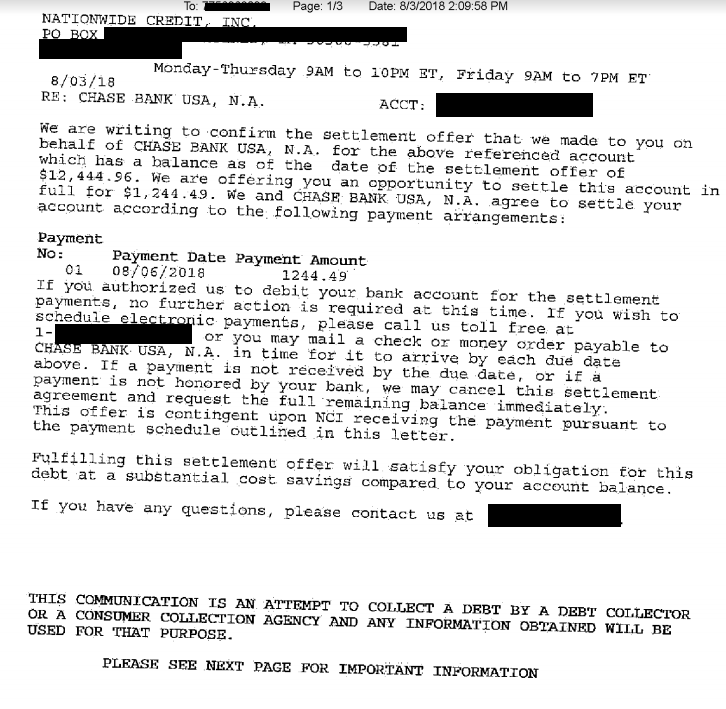

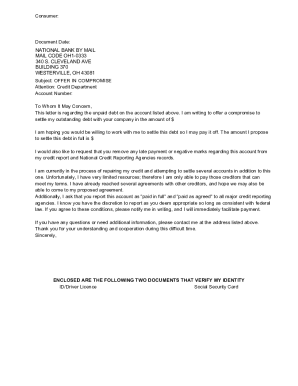

The following is a debt settlement letter for an account with chase bank.

How to settle debt with chase. Avoid bankruptcy and revive your credit! For this reason, while a debt settlement can reduce what you owe and prevent you from using the credit card (limiting your credit expenses), you should expect to see a credit score drop when a. When settling credit card debt with chase bank (and collectors for them), know that they deal with delinquent accounts differently than other creditors.

Debt counselors will aim to consolidate all of your credit card debt into a single payment, making it easier to manage and include in a budget. Get a free debt analysis now. In the letter, you can see the final negotiated resolution where the client saved.

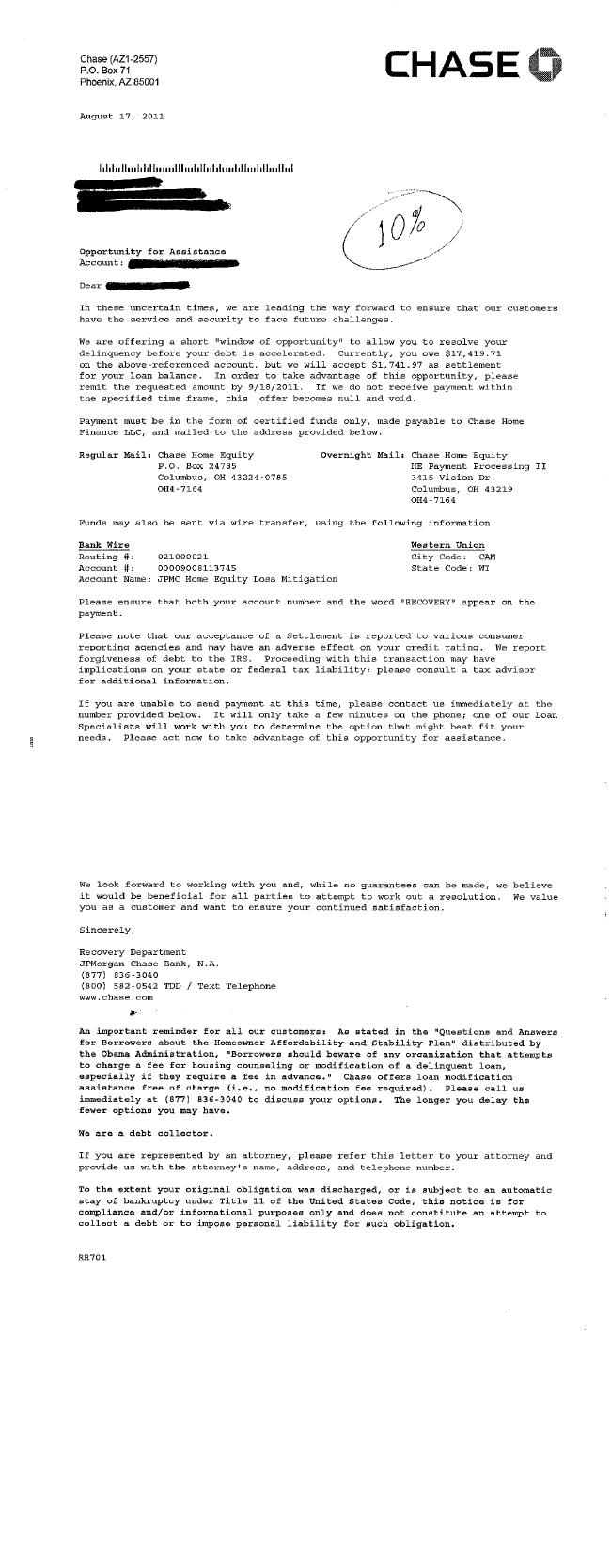

Use a balance transfer to move as. For chase customers, you can call the toll. A customer recently had chase offer them a 35% reduction or settlement of their debt on a total of $19,000 in unpaid bills that they had outstanding.

Either method can combat your credit card debt, provided you have a full understanding of all of your credit card's balances. In the end, i wound up with over $50k in credit card debt plus over $50k in consolidation loan debt plus tens of thousands more in my mortgage debt. Once you establish everything in writing and clearly obtained the.

Chase bank has agreed to pay $11.5 million to settle a class action lawsuit alleging the bank harmed credit card accountholders’ credit scores and even required them to. Call your card issuer and inquire about their debt settlement process. You can also seek external support to chase debts in other ways, and notably through a reputable debt collection agency, but be careful only to work with those who.

Americor will find the best solution for you. Lots of very useful info if you read some of the threads on the forum! You can also use both debt reduction methods by switching.