Inspirating Info About How To Lower Property Tax Los Angeles

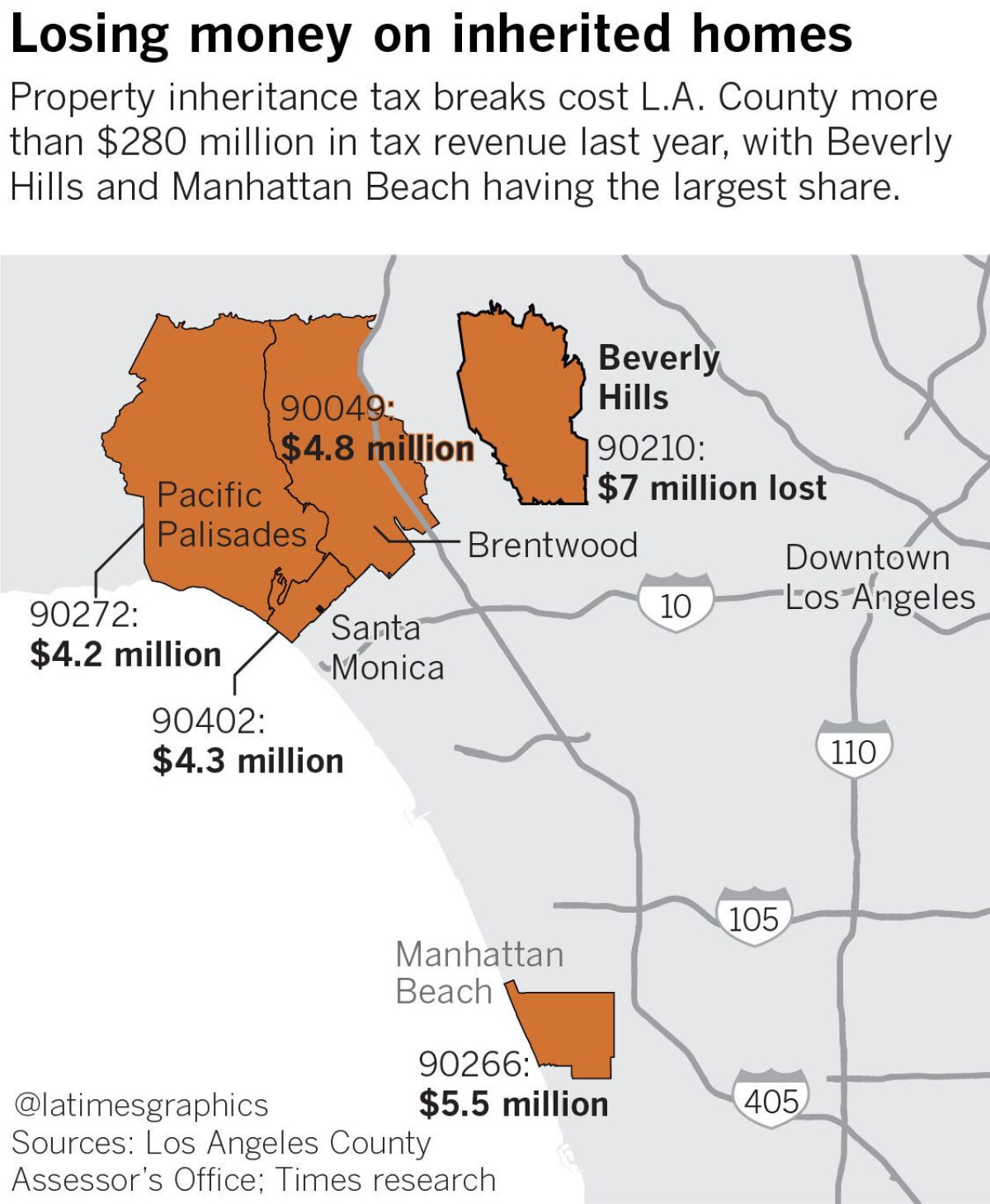

Ways to lower los angeles property tax liability there are many ways to lower your tax liability when it comes to property taxes in california.

How to lower property tax los angeles. Learn about accessory dwelling units and new construction, property tax savings programs, and more. Apply for property tax relief another way to potentially lower your property tax bill is by applying for tax relief programs. It’s free and open to the public!

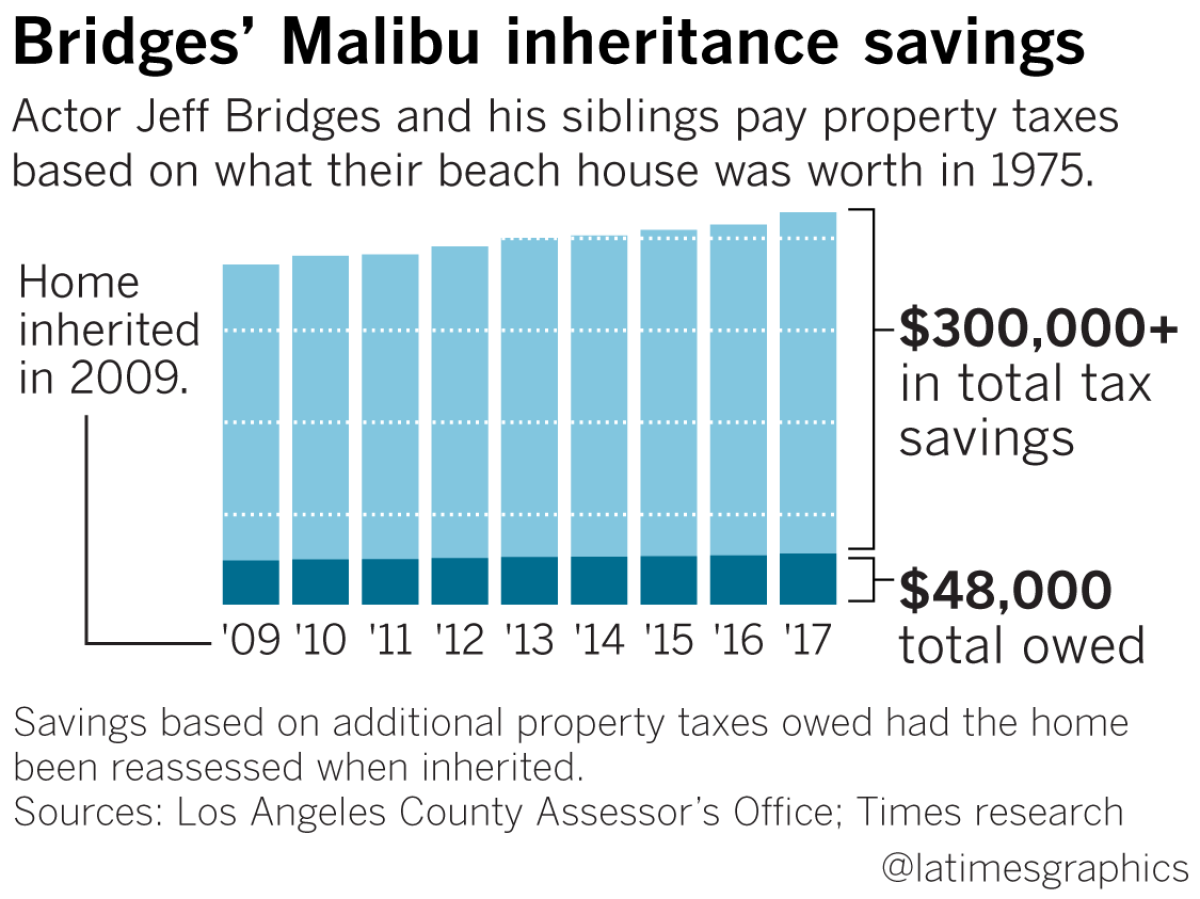

The average effective property tax rate in california is 0.73%, compared to the national rate, which sits at. Even a decrease of $10,000 can quickly add up in property tax savings, so be sure to have your property assessed regularly. One way is to take advantage of.

You can claim a $7000 exemption from the taxable value of your home. Los angeles, ca 90012 (213). These vary in every state and county, but they generally.

To qualify, the property needs to be your primary residence and you must make. Contact the los angeles county tax assessor’s office. Please provide the year and bill number, if available;.

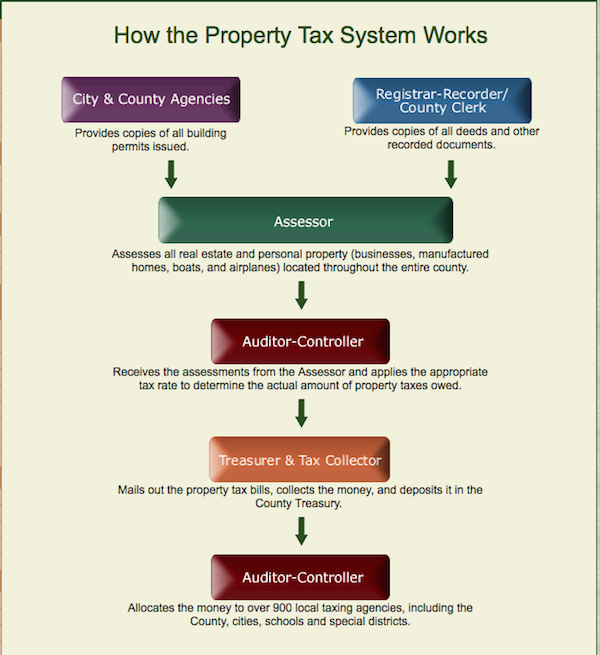

The homeowners’ exemption—you can apply if you own and use the. Here's an inside look at how property assessors screw homeowners to pay more property taxes. The assessment process when you file an appeal.

Lower your property taxes with these strategies! If you meet certain requirements, you can apply for property tax exemptions in los angeles.

![Four Factors Affecting Cities' Property Tax Revenues [Econtax Blog]](https://lao.ca.gov/Blog/Media/Image/534)