Perfect Info About How To Become Enrolled Agent

Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education.

How to become enrolled agent. Prepare for the ea exam to become an enrolled agent with our ea review course that will give you the confidence needed in obtaining the tax knowledge to prepare individual tax returns. See why we are trusted by the largest tax firms in the world. With five years of irs experience regularly interpreting tax regulations or.

Complete the pay.gov form 23 enrolled agent application and pay $67. Obtain a ptin through the irs. An enrolled agent is a person who has earned the privilege of representing taxpayers before the internal revenue.

For successful examination candidates, our goal is to have this. August 4, 2022/in information /by bryce welker. Ad leaders in enrolled agent exam review, irs afsp, tax & ea cpe.

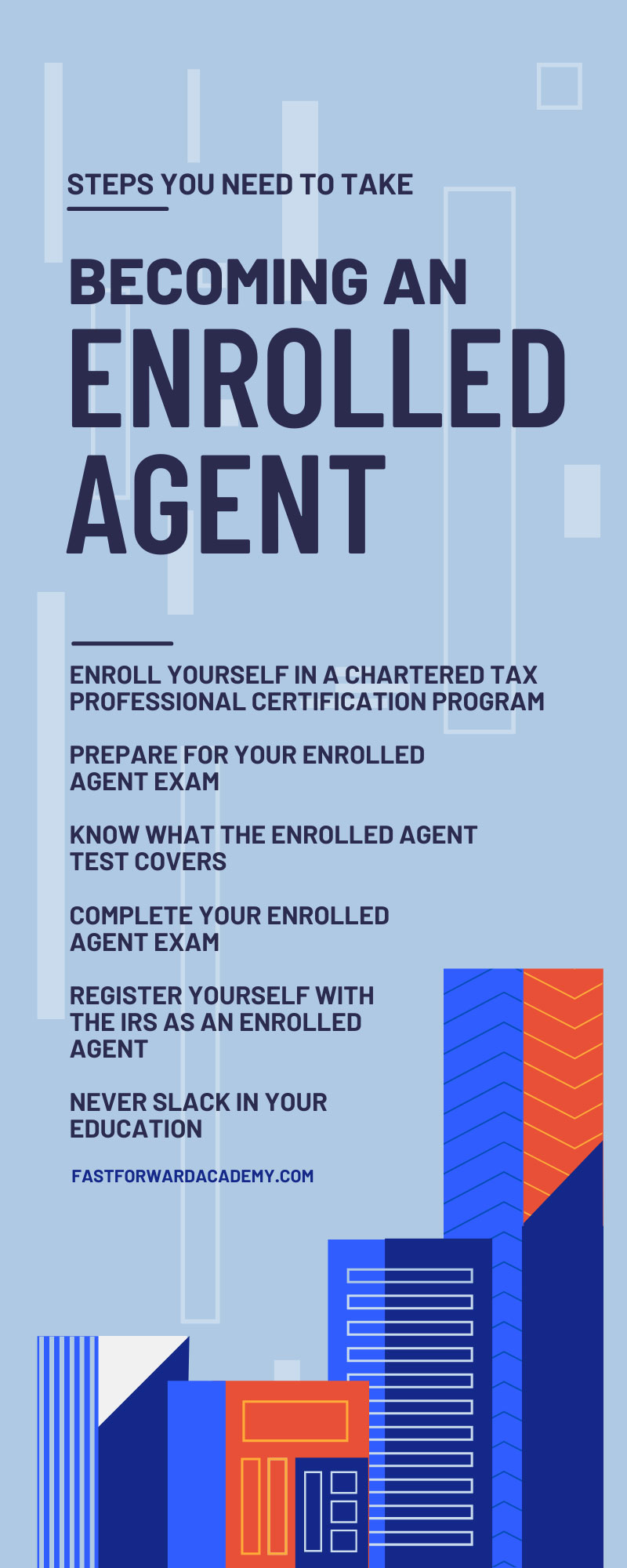

Enrolled agents (eas) can become credentialed in one of two ways: You can take and pass the online exam, or you can work for the irs. See form 23 pdf for additional details.

If you already have a ptin, you’ll need to make sure it’s current, and if isn’t, you’ll have to renew it. In addition, the proposed regulations increase the amount of both the enrollment and renewal user fee for enrolled agents from $30 to $67. The irs lists three steps to becoming an enrolled agent:

A minimum of 16 hours must be earned per year, two of which must be on ethics. The first step to becoming an enrolled agent is to obtain a ptin opens in new window. The enrolled agent credential is a nationally recognized certification offered by the irs for tax professionals.you can become an ea by obtaining a personal tax identification number.

![Enrolled Agent Exam [2021] | 500+ Questions](https://www.test-guide.com/images/Enrolled_Agent_Exam_Article.png)