Amazing Tips About How To Be Pci Compliance

Ad comprehensive library of interactive content.

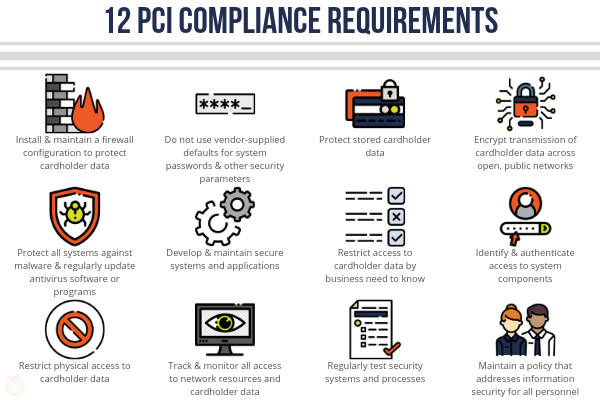

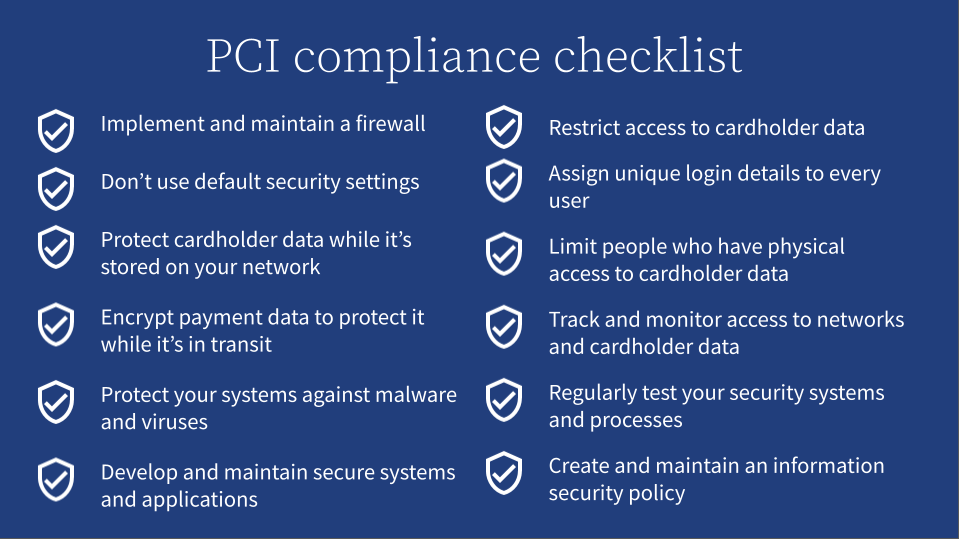

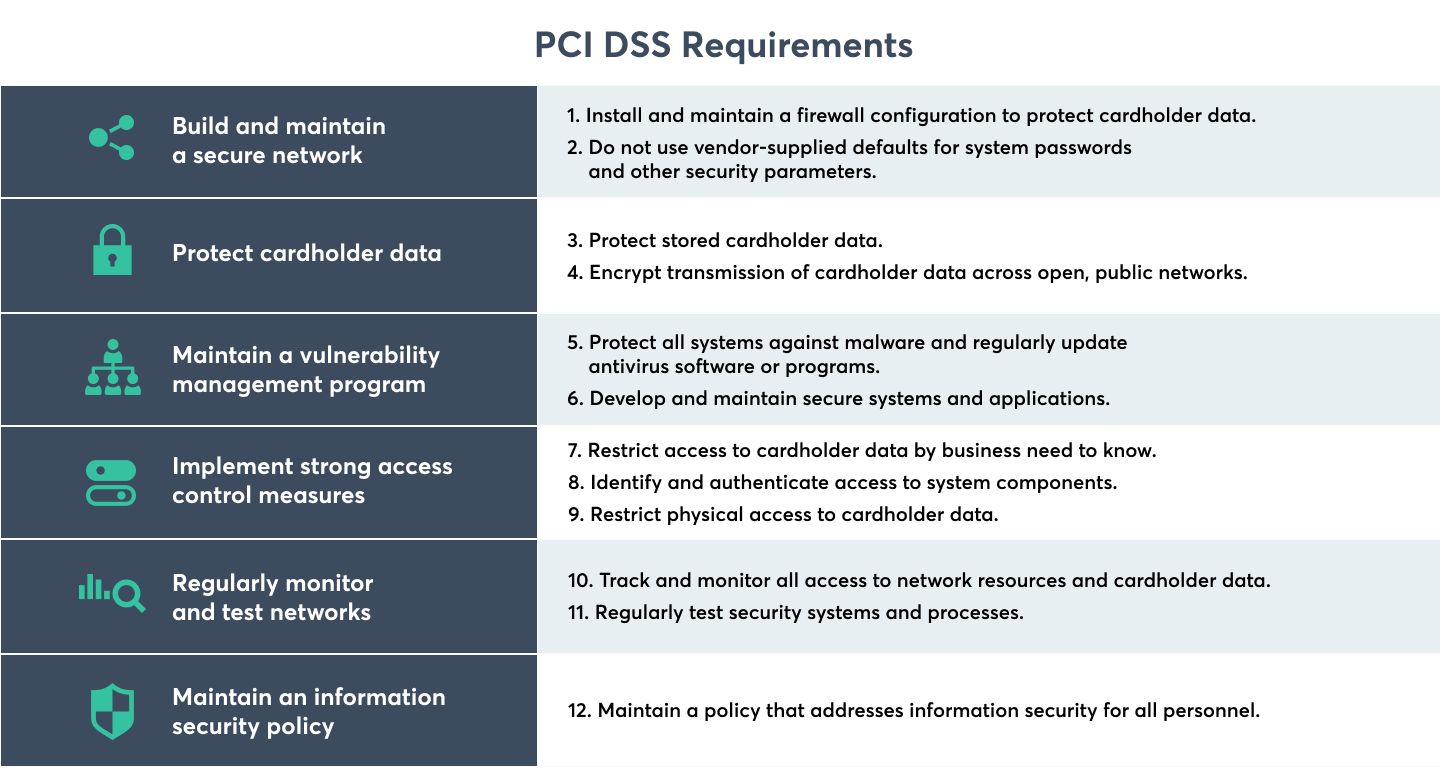

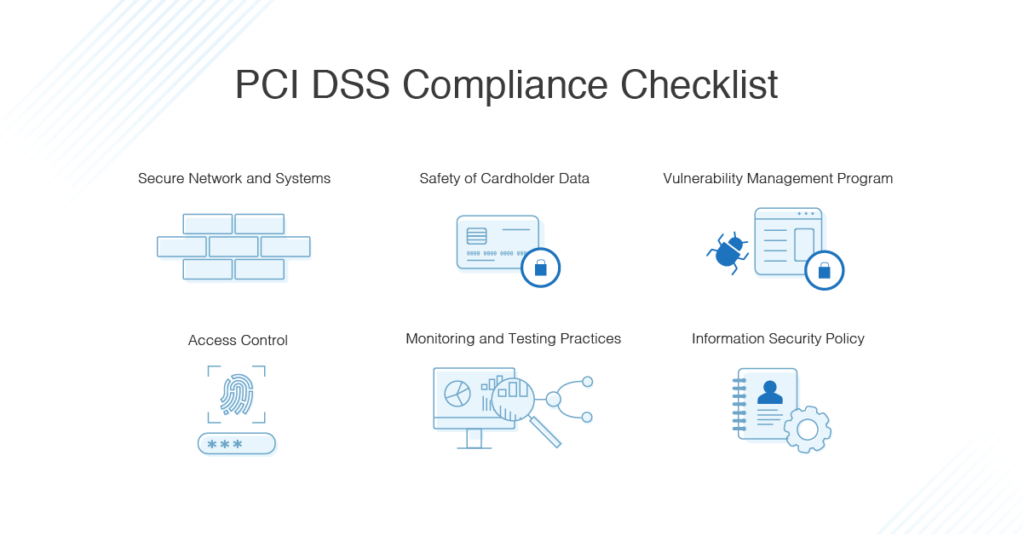

How to be pci compliance. At the end of the assessment, the qsa/isa will complete the report on pci compliance and formally document the results in the attestation of compliance. In the journey to becoming pci compliant, there are 12 steps you must complete, which the ssc separates into the following six goals. Pci provides clear guidelines for how to capture, process,.

As you can probably guess, becoming pci compliant and maintaining that compliance can be a complex process; It can involve implementing security controls, hiring a. Your acquiring bank is the authority when it comes to your pci compliance efforts, including whether or not you have to regularly prove compliance with the pci dss and how you prove.

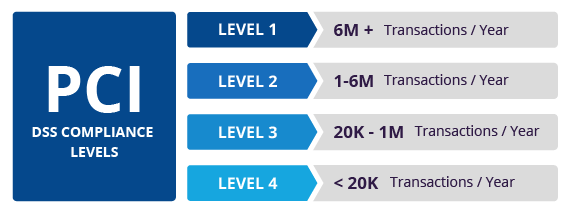

Review the best compliance programs for 2022. Pci dss (or just pci) is mandated by major credit card companies to standardize the protection of cardholder data. The 12 requirements of pci security standards.

How to become pci compliant: To become pci compliant, you must meet the 12 pci compliance requirements, which are split up into 300 sub. To achieve pci dss compliance, businesses must implement pci defined controls focussed on six pci compliance goals.

It is an ongoing process that aids in preventing future security breaches. In total, there are 12 requirements with actionable steps. You need to complete an attestation of compliance form, a.

Basic pci compliance is about using systems that prevent unauthorized access from untrusted actors. Pci compliance also contributes to the safety of the worldwide payment card data security solution. However, enforcing the compliance of pci dss is the responsibility of the individual payment brands.