Fabulous Tips About How To Avoid Tax Audit

Enrolled agents are registered with the irs, so you can be sure they’re on the level.

How to avoid tax audit. The best way to avoid these situations is to use an enrolled agent to prepare your tax returns. Just be prepared if the irs does tap you on the shoulder for an income tax audit. When someone issues you a tax form that reports income, such as a 1099, they also.

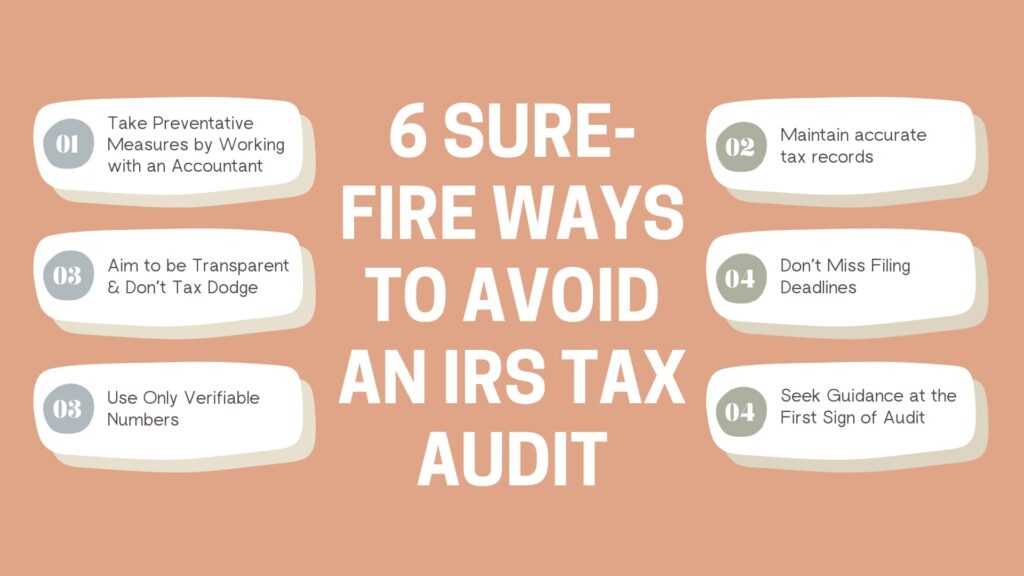

Here are five tips to help you avoid a tax audit: How to avoid a tax audit: Whatever numbers you or your preparer come up with, make sure you have documentation to back them up, zelin said.

Here are a few ways to lower the odds of getting audited this tax season: There is no guaranteed way to avoid and irs audit but there are things a taxpayer can do to lower their probability or propensity of being audited: How to avoid a tax audit:

If you give them accurate information, they will know the best. 7 tips for small business owners 1. File your taxes on time, even if you have a loss or you owe no taxes, advises hal shelton, score.

Get paid $200 by signing up for this new card. Here are your best options. 2.1 don’t use problem tax preparers;

But if you fail to file your taxes on time, you automatically put an audit. How to avoid a tax audit: 1 what is an irs audit?