Smart Info About How To Apply For Hud Loan

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

Ask an fha lender to tell you more about fha loan products.

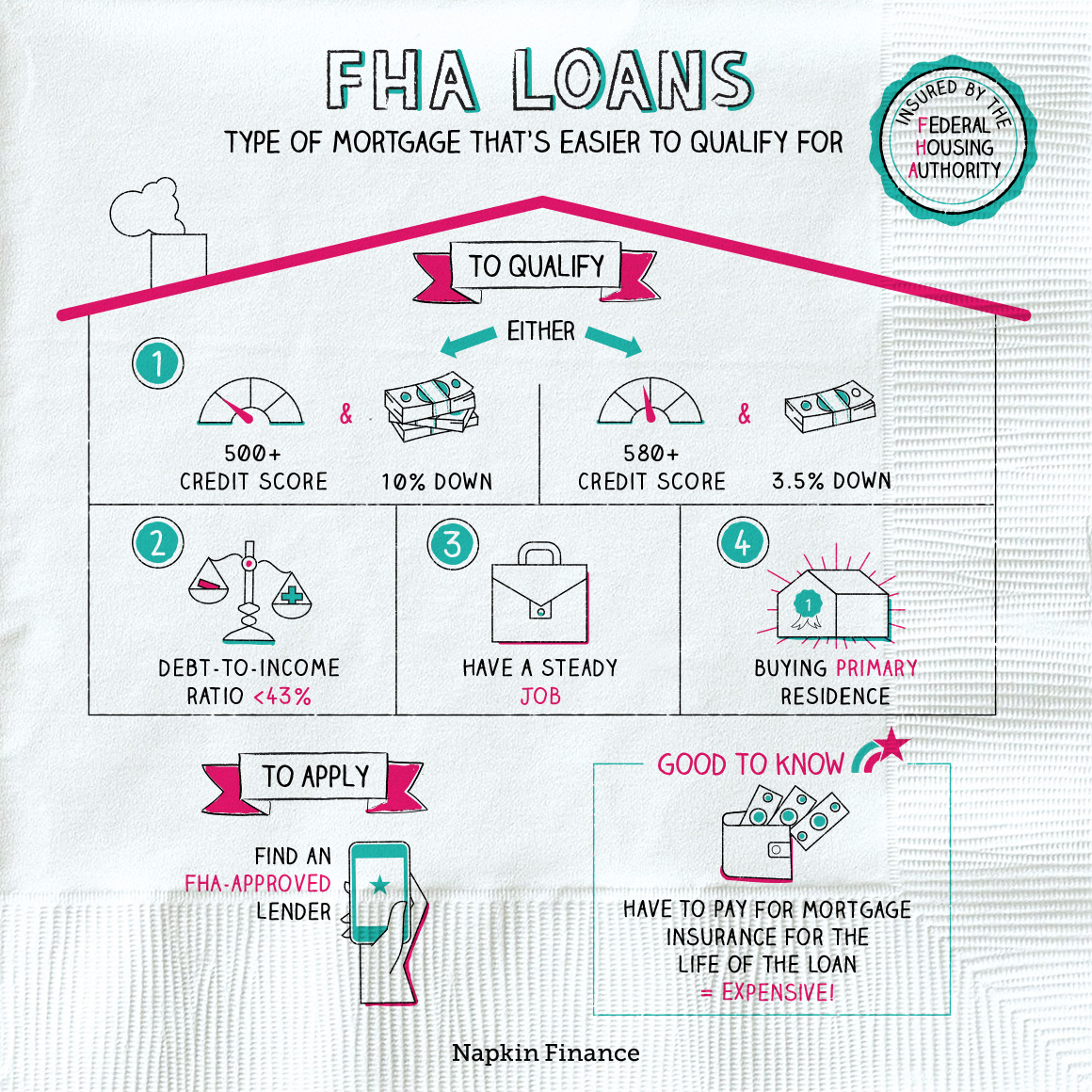

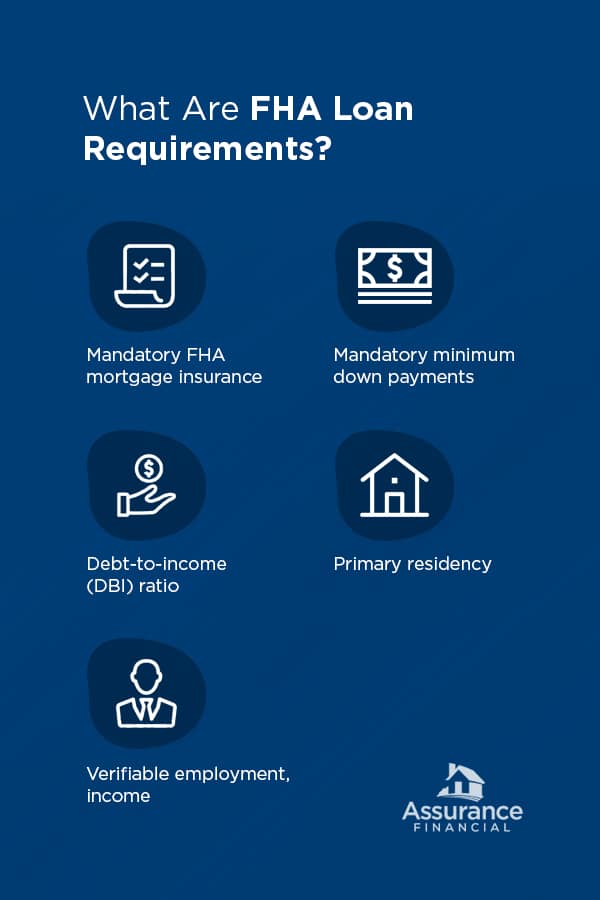

How to apply for hud loan. Ask an fha lender to tell you. How to apply for a hud 223(f) loan. Hud homes are residential properties that were once owned by homeowners who financed their mortgages through the federal housing administration (fha), a u.s.

Invite the lender to apply for a firm commitment for mortgage insurance, or. The application process for hud 223(f) loans can be broken. Borrowers who hold student loan debt must apply for relief of up to $20,000, according to the white house.

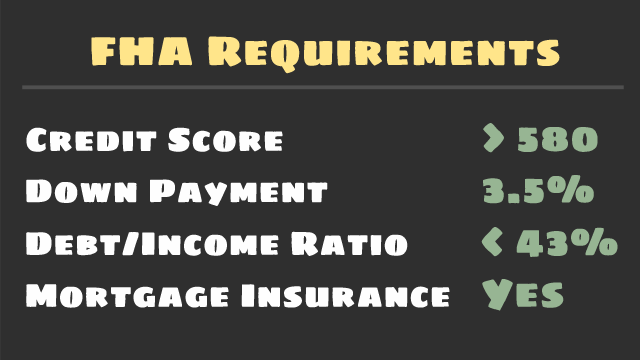

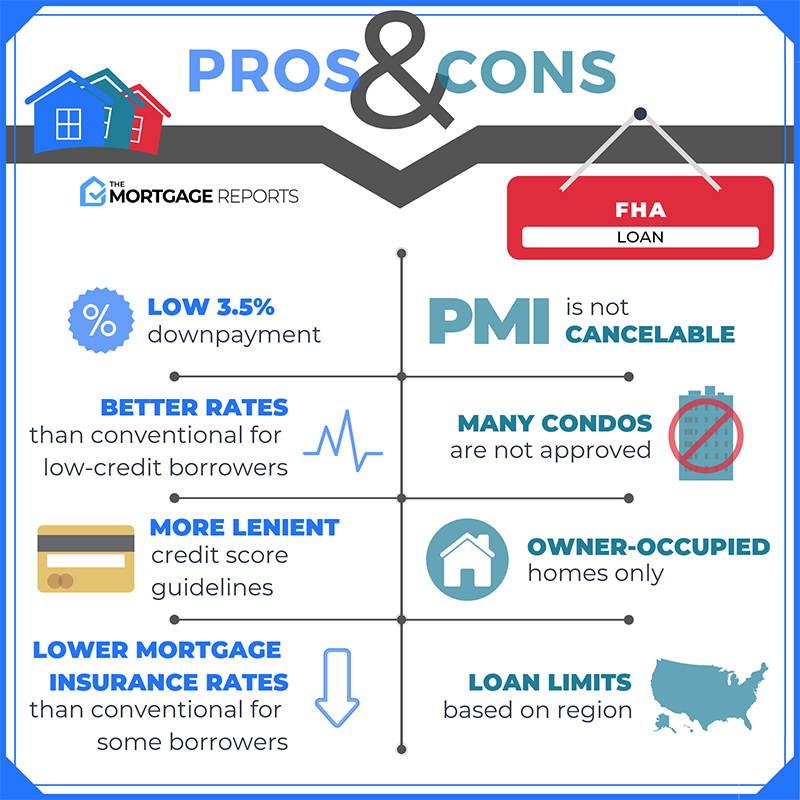

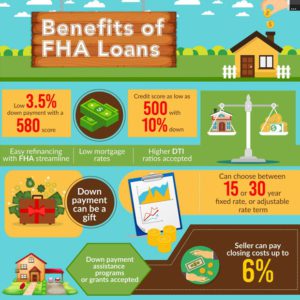

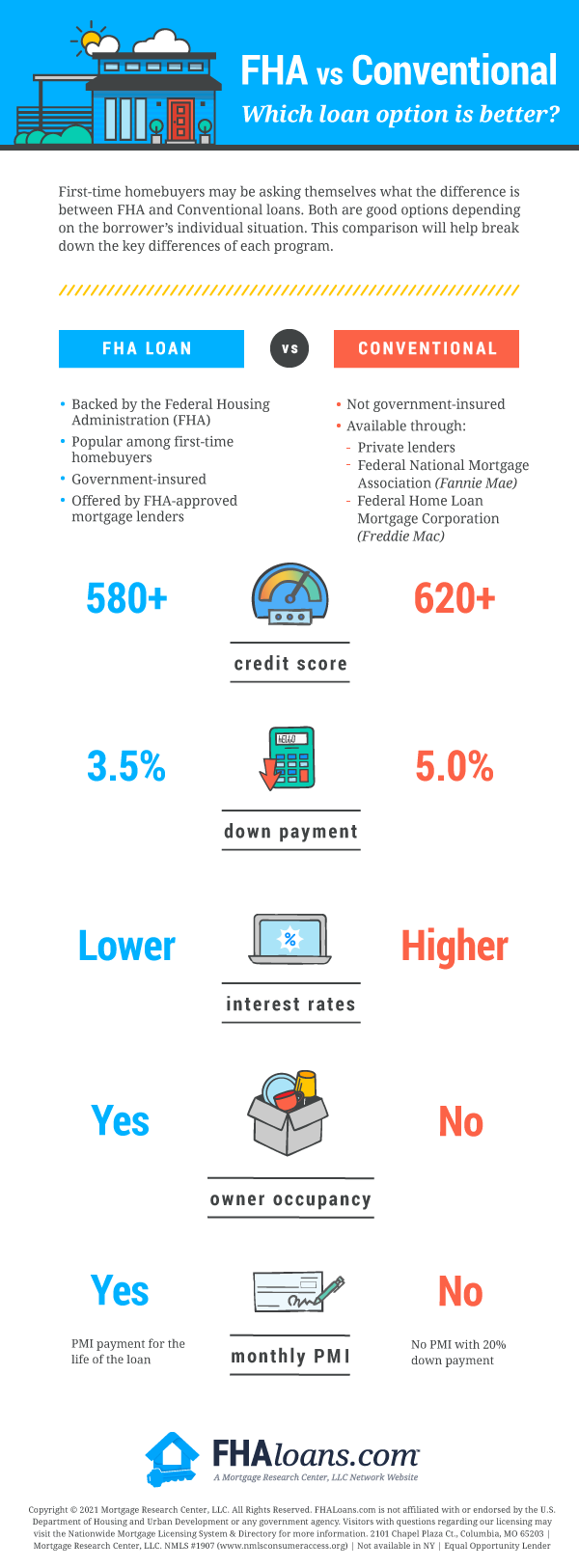

Borrowers with a minimum decision credit score at or above 580 are eligible for maximum financing. Choose smart & apply easily. What does your credit score have to be for a hud loan?

Ad check your fha mortgage eligibility today. Save money for a down payment. Special offers just a click away!

Contact a loan specialist to get a personalized fha loan quote. Savings include low down payment. Ad compare the best mortgage lender to finance you new home.

Borrowers with a minimum decision.

/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)